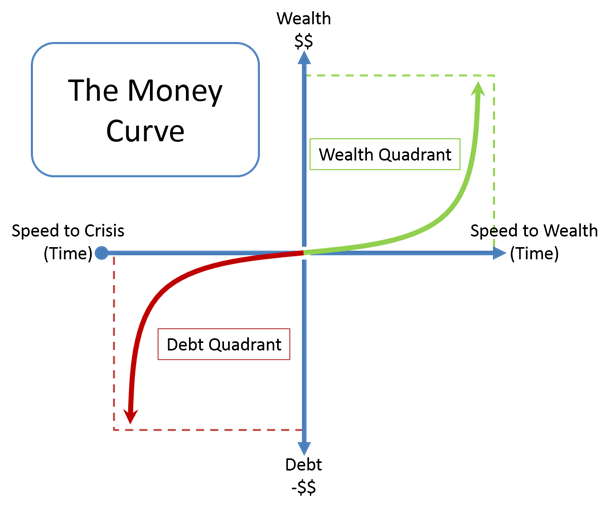

One of my favorite concepts from the book is that of The Money Curve (pictured above). This curve highlights a couple of important relationships: time vs. interest rate and debt vs. investing.

Time vs. Interest Rate

The horizontal axis represents time and the scale of that axis is controlled by interest rate. In other words, the higher the interest rate on debt, the faster you will move towards a financial crises (the left of the curve); conversely, the higher the interest rate (or rate of return) on the investment, the faster you will move towards wealth (the right side of the curve).

Debt vs. Investing

The quadrants of the curve represent debt (bottom-left) and wealth (top-right). As a person moves out of debt, they can begin to build wealth. Debt and wealth are all part of the same curve – the same financial journey. They simply represent different points on the journey.

For more information on the Money Curve and a more in-depth discussion for how to apply it, be sure to review Chapter 6 (“Principle 4: Money Seeds Money”)!