The 6 Principles

What are the 6 business principles you can use to advance your own finances?This book covers 6 fundamental principles that are used to guide successful financial management in the world of business. These principles have been generalized and adapted to suit personal financial management as well. Below are highlights of concepts and topics covered in each of these 6 important principles.

Some chapter also define important financial terms applied both in business and personal finances. You can also preview the terms in the relevant sections below.

Know Your Destination

Key Concepts

- Having a vision/mission; a sense of purpose

- Money as an engine for growth, not a destination

Mind Your Shareholders

Key Concepts

- Companies are owned by shareholders

- Investing is a way to give up something of value now for the expectation of greater value in the future

- We want to make investments that bring us a return greater than our original investment

- Shareholders expect the company to be successful

- We have an obligation to protect the long term welfare of the shareholders in our life

Definitions

- Stakeholder

- Share

- Shareholder (AKA Stockholder)

- Invest

- Investor

- Return

- Dividend

- Majority Shareholder

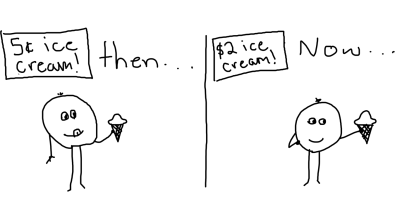

Time Changes Value

Key Concepts

- Money provides a medium for exchanging common values for goods and services

- The value of what money can buy changes over time – a dollar today is not the same as a dollar tomorrow

Definitions

- Purchasing Power

- Inflation

- Deflation

- Projection (AKA Forecast)

- Cash Flows

- Discounting

Money Seeds Money

Key Concepts

- Productivity is at the root of money growth and the heart of the Value Cycle

- The Value Cycle takes increased productivity and re-invests it to continue growing

- Every dollar has the potential to grow, but requires the right “soil”

- Because of compounding, money can grow, exponentially

- Because of compounding, money can shrink, exponentially

- The Money Curve provides a map of where we are on our path of financial growth

- Paying off debt is investing in our financial future by propelling us towards the path of future growth

- There are two levers that affect how we move along the Money Curve: Quantity and Interest Rate

Definitions

- Compounding

- Rate of Return

See Tomorrow, Today

Key Concepts

- Life spans are increasing, which results in increasing costs for retirement

- Most of the US is not on track to have adequate funds for retirement

- Saving money now for our retirement is critical to the success and happiness of our shareholders

Spending Closes Doors

Key Concepts

- When we spend money, we are also making a choice not to spend or invest that money elsewhere

- The price of something is not a true reflection of its value

- Spending money now costs us the opportunity for that money to grow into the future

Definitions

- Opportunity Cost

- Utility

Advance Your Personal Finances Today!

Buy your own copy of “Your Money. Your Business.” and learn the 6 business principles you can immediately begin using to advance your financial goals!